Positioning your brand strategically in the Chinese market and localising your brand accordingly are important steps to successfully market your brand in China.

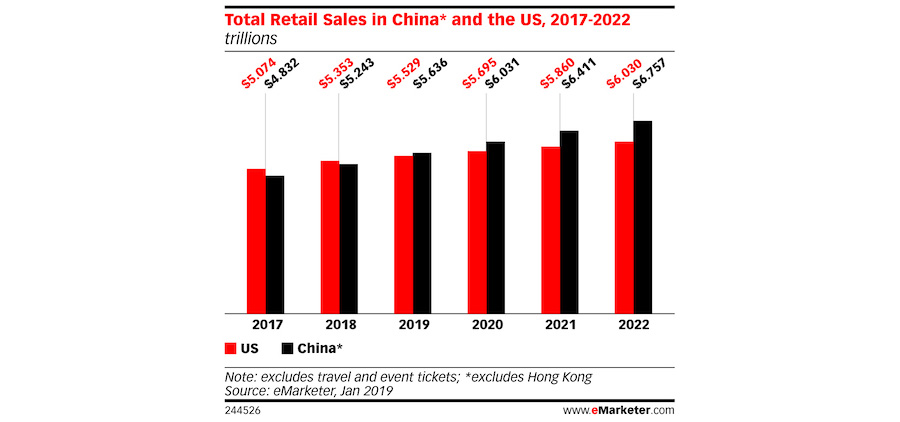

Reports have shown that China’s consumer retail sales market is simply too big to ignore. Consumption is forecasted to remain the largest contributor to China’s economic growth in 2019.

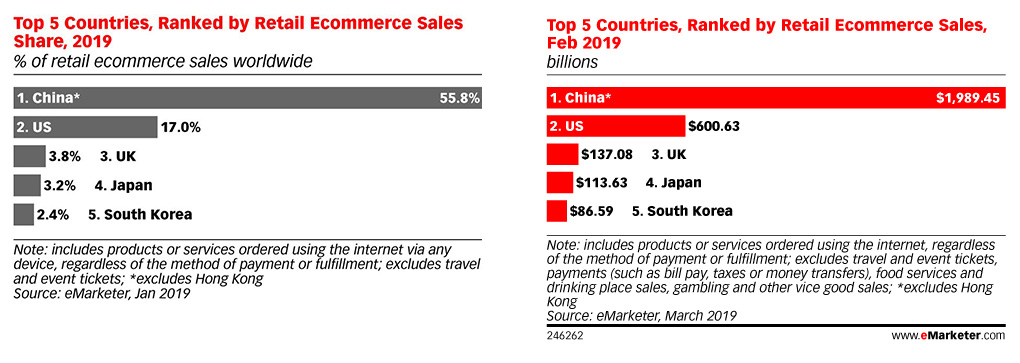

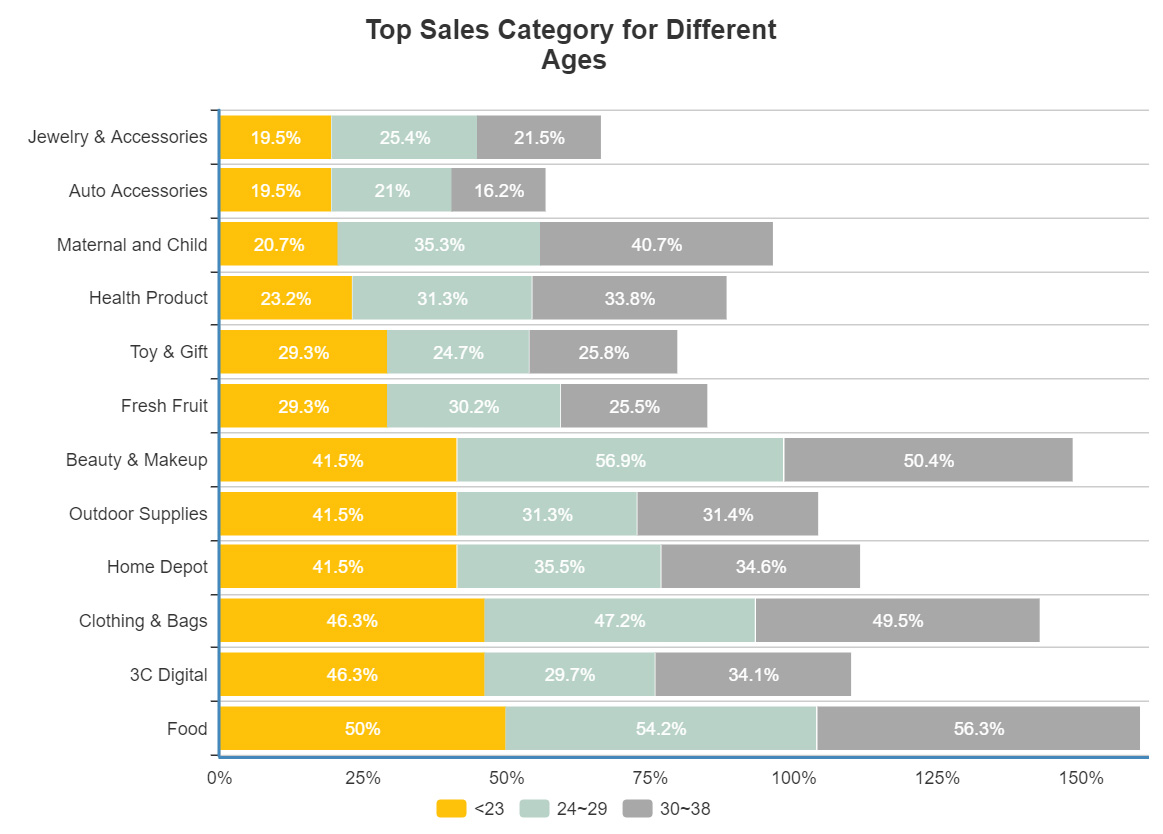

Official data indicates that China’s public consumer good retail sales volume was 38.0987 trillion RMB for the full year of 2017, and analysts are expecting this figure to reach the 40 trillion threshold by the end of 2019. According to official reports, e-commerce is a key driver of the growth in Chinese consumption, with online retail sales making up 9 trillion RMB of the retail sales share in 2018. Compared to the statistics generated in 2018, online sales in the first quarter of 2019 saw an increase by 15.3%; driven by food, clothing and other commodities which increased by 24.6%, 19.1% and 21.3% respectively.

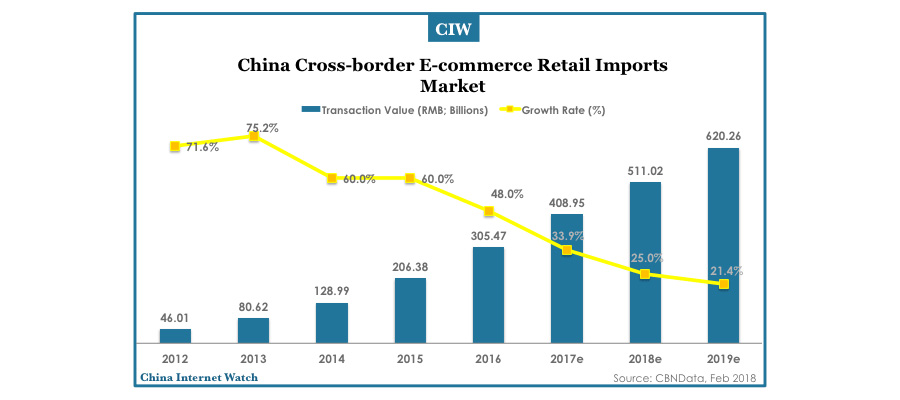

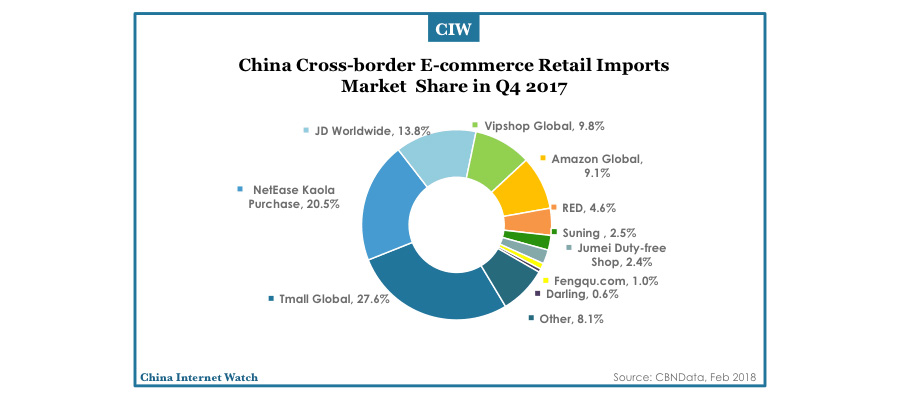

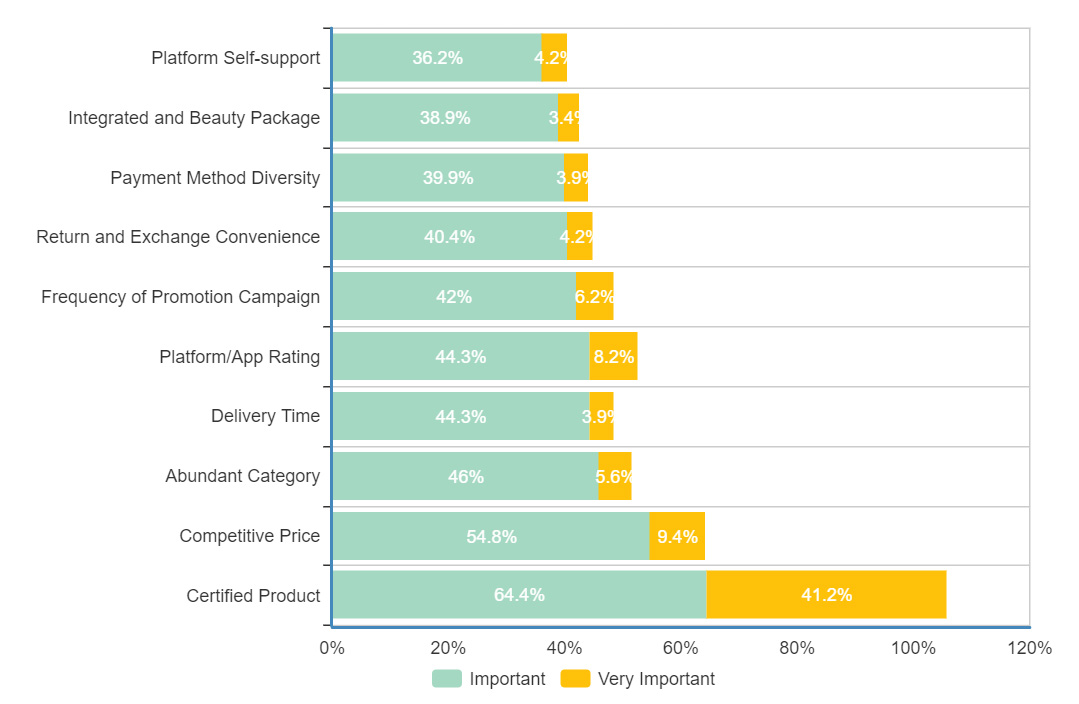

Consumers are reportedly turning to online marketplaces to buy everyday items from international brands. Cross-border e-commerce is rising in China in response to the increasing demand of imported international brands among Chinese consumers. Approximately 24% of China’s digital shoppers had made a cross-border purchase in 2018. These figures show great prospects for international brands looking to break into the Chinese market.

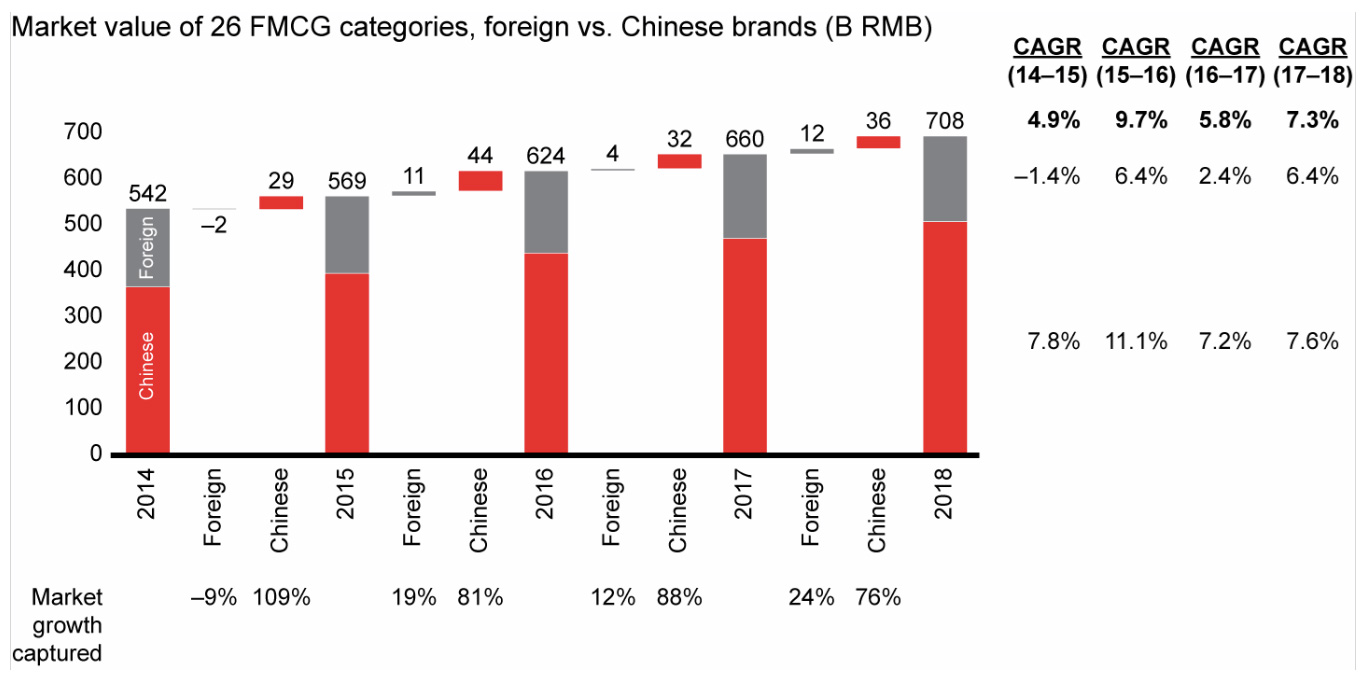

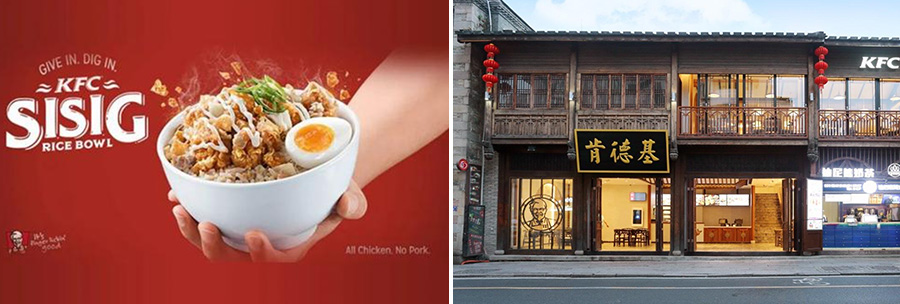

However, there is a competing trend showing that Chinese consumers are increasingly favouring local brands. Over the past years, the number of local Chinese brands in the top 50 multinational companies has increased – from 18 in 2016 to 20 in 2017, and an impressive 30 brands were included in the ranking in 2018. Global companies no longer “globalise” as a strategy, but are now taking on a new mindset: a local mindset. Localisation is now key for foreign businesses to succeed in the Chinese market.

Many brands around the globe have made their way into the Chinese market. Not only does your business have to compete with these established and incoming foreign brands in the saturated Chinese market, you also have to compete with domestic brands that are becoming increasingly innovative in their marketing strategies.

To come out successful in such fierce competition, your business should focus on more targeted brand positioning and communication using both online and offline channels.

Localising your positioning and messaging greatly affects how well your target audience respond to your brand. For instance, Shanghainese generally relate to more creative and international positioning due to their metropolitan and modern outlook. On the other hand, a more functional messaging may resonate stronger among consumers in Guangzhou as majority of the city’s population live close to families and speak Cantonese.

We can assist you in navigating the sophistication and preferences of the different local areas in China and to also help you develop marketing strategies customised to the cities and demographics your business would like to target.

Traditional promotional advertising such as TV, radio, outdoor advertising, and newspaper commercials is an area that is underestimated by foreign brands, especially with the wealth of digital channels available. Localising traditional media commercials is a great way for local consumers to feel more connected to your brand.

In addition, there is also the less obvious but no less important way to market and communicate your brand is through offline methods, such as offline events, press conferences, in-store promotions and roadshows, as well as sampling. These offline marketing methods are popular strategy in China, especially for new foreign brands that are introducing products that Chinese consumers are less familiar with.

Consumers can physically engage with your products and try samples – increasing your brand and product credibility and reliability. However, depending on the geographical area in China you are targeting, you would have to tailor these on-site marketing efforts according to the local preferences and norms.

Online or digital marketing involves many channels. E-commerce, social media and websites are three key outlets many brands focus their marketing efforts on. While these online channels are effective in reaching a wide range of audience from different locations in China, it is important to know how to localise and personalise your brand communication according to the online medium you are using.

For instance, WeChat allows marketers to segment fans or followers with its unique QR codes for different locations which allows localised messages to be sent. Besides that, advertising messages can be directed to landing pages specific to a city or province using Baidu, a widely used Chinese search engine.

We have the resources, knowledge and expertise to assist you in both online and offline brand communication and marketing. We will help you integrate localisation strategies into your marketing and business plan to help expand your brand’s reach effectively.

Your website should represent and communicate your brand effectively. We have the tools your business needs to optimise your website on search engines.

Your website is one of the first points of contact with your target group – regardless of whether you are reaching out to businesses or consumers. It is thus important to create a website that aligns with the Chinese web-surfing behaviour and habits.

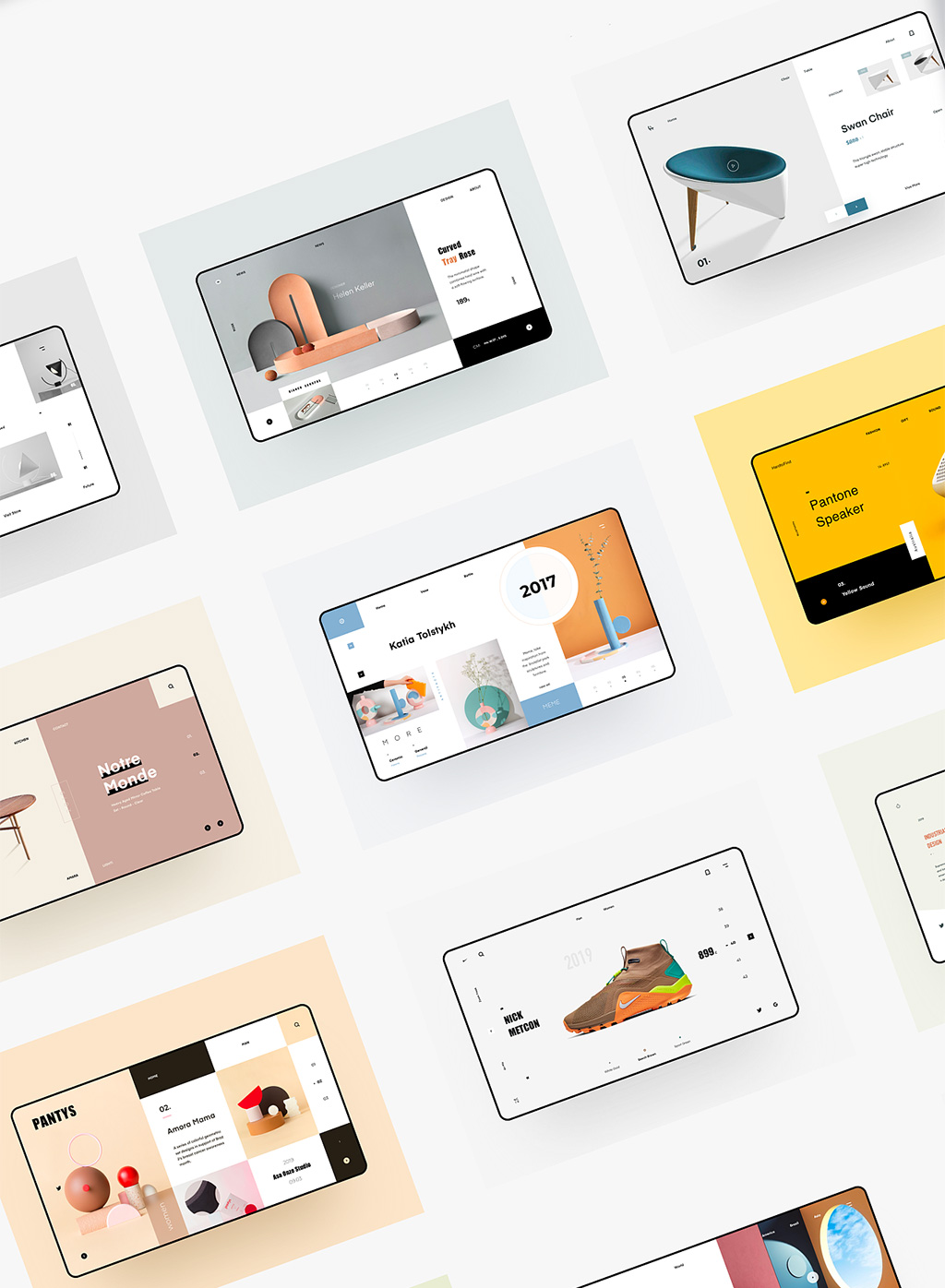

It is also important to note that the website you create for your Chinese audience is not merely a site to introduce your products or services – it should reflect your overall brand image and align with your branding strategy. This involves more than just a simple translation of your original website that your business have been using outside of China. The language and the design of your website should align with your brand localisation strategies that are based on the Chinese consumer behaviour and preferences.

Our goal of our website service is to ensure that the design of your website attracts also Chinese viewers. Not only should your website be aesthetically-pleasing, it should also be functional (e.g. mobile-friendly) – our services will take care of that too. Moreover, we can assist businesses that conduct online sales on their websites by providing the required functions for online sales and payment on their website.

Our service does not only end at helping you create an attractive website. We also make sure that your website is well-optimised for search engines favoured by the locals.

Unlike other parts of the world, Google is inaccessible in China. Baidu is the leading search engine in China, followed by Sogou, Shenma and Haosou. These search engines have different criteria in their page and site ranking mechanism, which you may not be familiar with.

Similarly, search engine marketing (SEM) applications and tools of these local search engines are different from what you would find on Google (e.g. Google Adwords). There are different advertising products and different ad delivery methods that your business can benefit from.

Our team has the skills and expertise to ensure that your website and online ads are optimised for local search engines. We cater our SEO and SEM services to your business’s needs and plans.

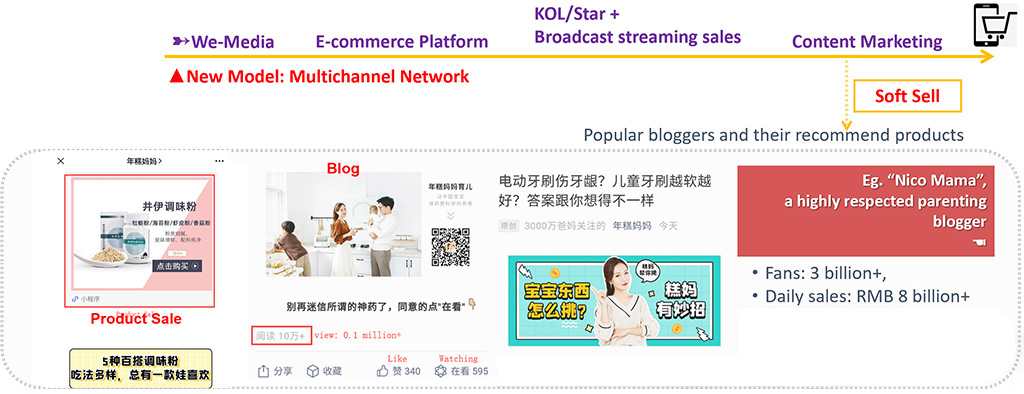

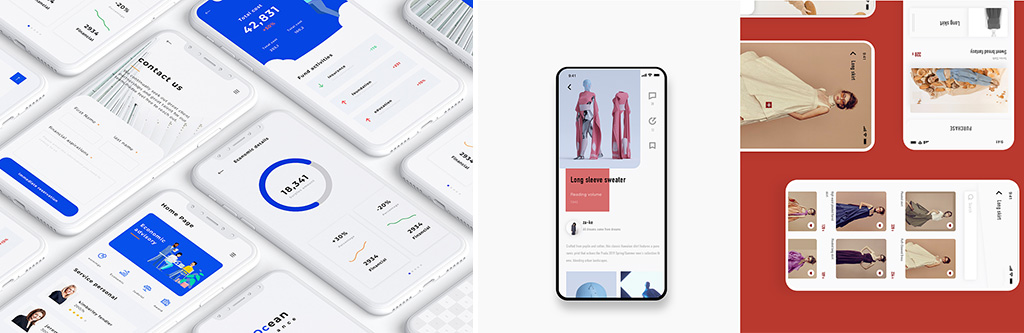

There are several strategies available when it comes to setting up online stores. However, trends show that social commerce is a phenomenon that marketers should leverage to maximise their branding and marketing outcome.

One conventional way to conduct business is through your company or official website. This involves having your products displayed on your website and incorporating online payment functions to facilitate purchase. Design and functionality are both important when incorporating an online store into your website.

However it should be noted that purchasing through official website is not a common behaviour in China. When it come to certain brands and products, consumers are more used to search them on big platforms such as Tmall, JD, or from social media with special promotion and passionate sales pitch from KOLs. However, an official website indicates seriousness in business and high-end customers may find it convincing and appealing.

We also extend our website services to include online store functions (e.g. payment solutions and online chat) and design services. We are also able to help you with logistic solutions (e.g. product delivery) that you may need during the operation of your online store.

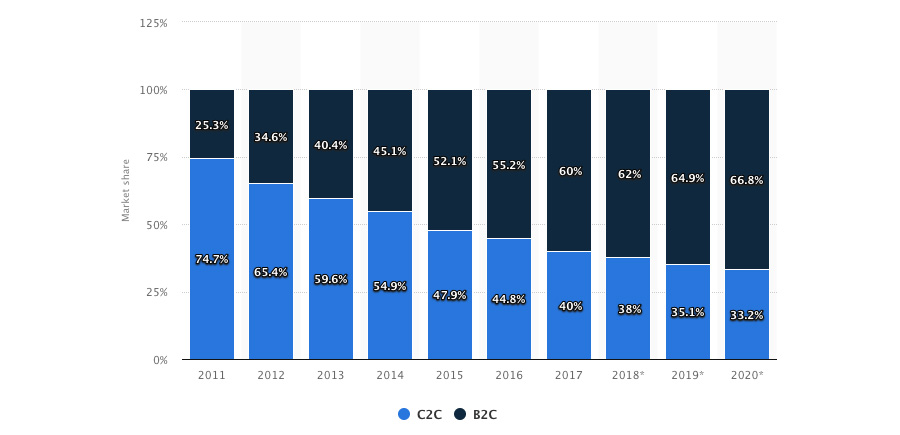

While having an online store on your website is convenient and relatively easier to manage, the trend in China is pointing towards social media commerce as the main outlet that businesses should pay attention to. Social commerce is a blend of social media and e-commerce, and China is ahead of the curve in this area. In addition, reports have found that 70% of Chinese born after 1995 will turn to social media to purchase products as opposed to other channels.

Chinese consumers are highly mobile and immensely social. This unique behaviour has been pushing the social commerce trend forward. The trend has become so dominant that some companies focus specifically on social commerce, such as Little Red Book and Pinduoduo, while other more traditional platforms are increasingly adopting a hybrid approach as seen in social media platforms opening their own online stores and e-commerce sites adding more ‘social’ and editorial content.

Example: WeChat

WeChat’s mini program is one function that allows merchants to redirect WeChat users onto the shop page of your website. Alternatively, you can use the mini program function to create a ‘mini app store’ specifically for WeChat users without having to link it to your website.

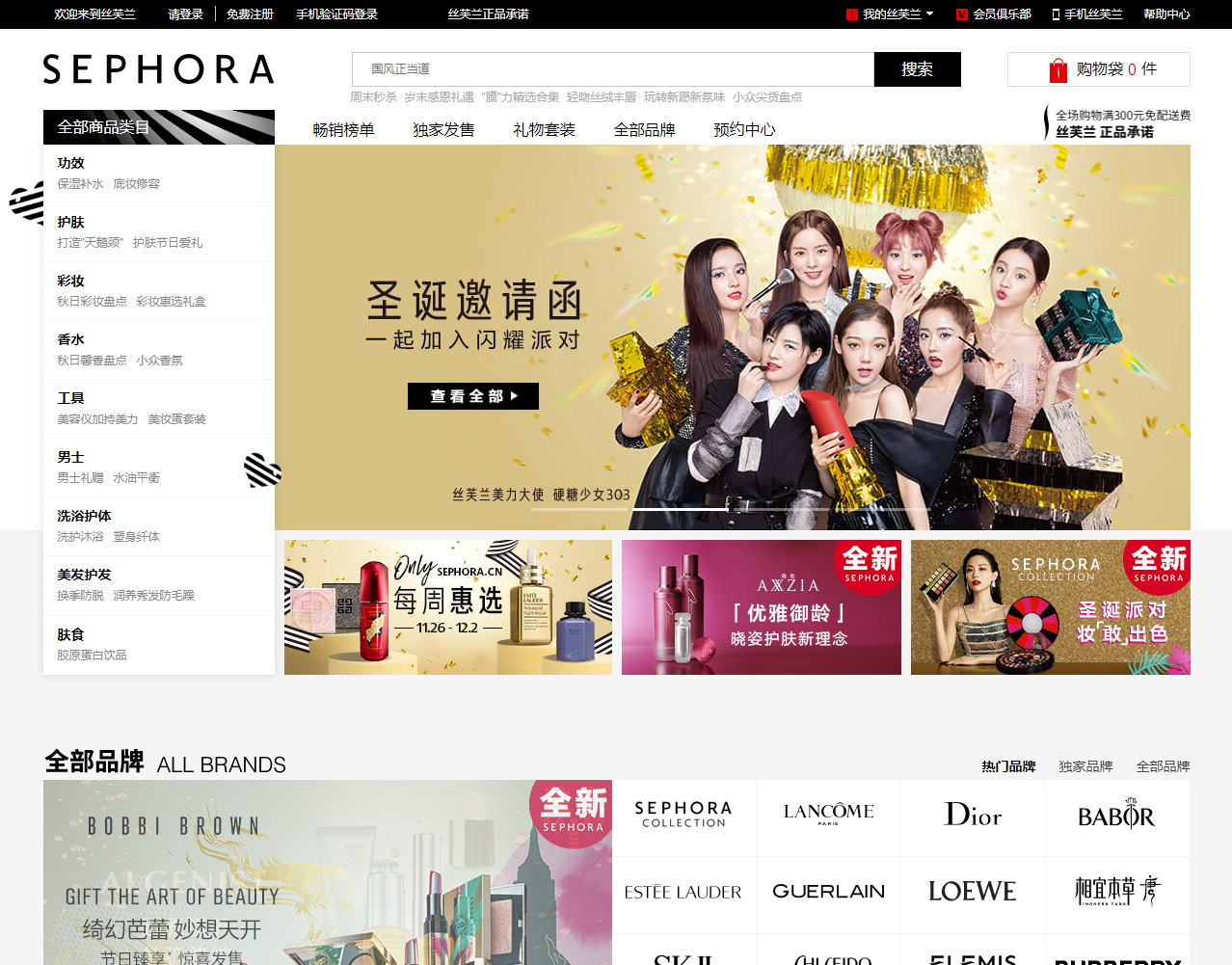

One case study to look at is international beauty company, Sephora. Sephora caught on to the trend of social commerce and created a strong WeChat presence. Sephora recognised the importance of building a community that chats and shares about their brand and products. Tapping onto the WeChat’s social element, Sephora strategically initiated the “Member Get Member” program on WeChat, where Sephora members are given rewards for inviting friends to sign up and try more products. Additionally, Sephora uses the mini program function to roll out deals and special offers, and customers can update their in-store loyalty program on the app to access these benefits.

Depending on the nature of your business and marketing needs, our team can help plan your social commerce initiatives using the right platform while maximising your existing resources. Social commerce is a unique opportunity in China that your business should not miss out on – and we are here to guide you step by step.

It is vital to realize that B2C is no longer the old-fashioned stock then sell. When there are so many fans community available on social media, distributors can easily find the most suitable potential clientele, to directly sell through content marketing. The value-chain is shortened, time is saved and the marketing is effective.